Over the last couple of years, many global corporations and investors have started to investigate the voluntary carbon market (VCM) as a vehicle to achieve environmental goals and make smart investment decisions. Rightfully so – currently the VCM is the largest existing non-mandated market that financially supports environmental projects that deliver real and verified impact on the ground.

Last year alone, $2bn worth of carbon credits[1] were traded in the market, which translates into millions of hectares of protected forests and hundreds of thousands of clean cooking devices distributed to households, among other benefits.

High-quality carbon credit supply squeeze

The market, of course, has its challenges. Many market participants acknowledge there are simply not enough high-quality carbon projects to fulfil the projected demand from corporates looking to achieve their climate goals. There is also a lot of debate about what a high-quality carbon credit actually means. You can read our insights in the Whitepaper on Quality here.

What became visible over the last two years is that an increasing number of buyers and investors sought to participate at an earlier stage of project development through new forms of financing in order to close the supply gap. Part of the reason was that they wanted to ensure that the newly developed carbon projects are of high quality and integrity.

Another reason was to provide the much-needed capital for project implementation and expansion at a faster pace, especially for those projects whose early implementation costs can be highly prohibitive for project developers. A recent report from BNY Mellon estimates that the world will need to spend $100tn on green investments in order to reach net zero by 2050. This equates to around a fifth of the total anticipated global investment over the next 30 years.

New financing solutions are emerging

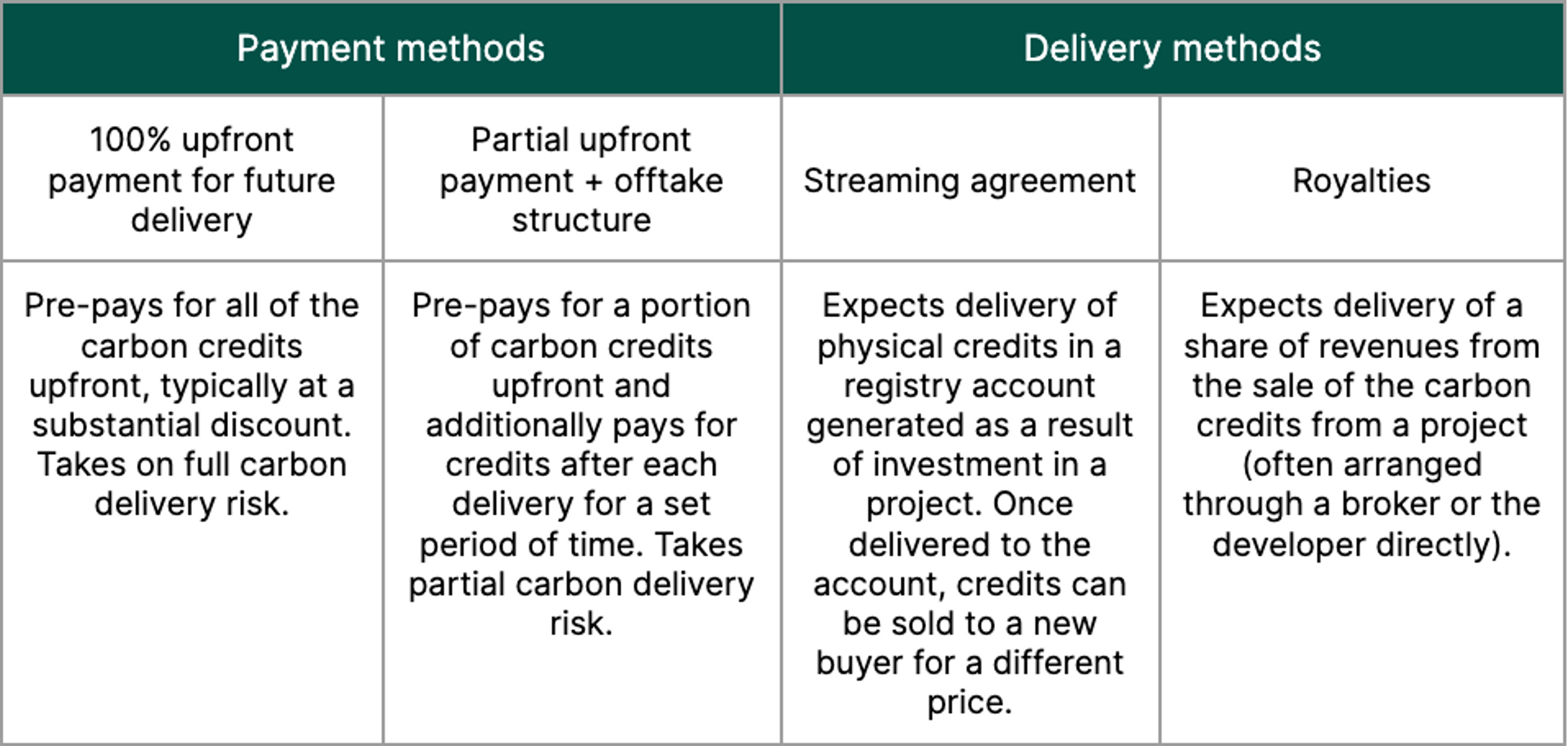

Different solutions are being tested to finance the development of carbon projects. New forms of financing have emerged in the space which are called “carbon streaming” or “royalties financing”. These forms of financing are being advanced by new entrants in the voluntary carbon space such as Carbon Streaming Corp, Green Star Royalties and Key Carbon, amongst others.

Streaming is a method borrowed from the mining and minerals industry whereby a financier provides up-front cash in exchange for a future stream (share) of a certain commodity at a discounted price compared to the prevailing spot market price[2].

In the carbon space, the deal can be structured around how much money a project developer needs today to successfully implement activities, but it may also involve additional payments by the streaming company once the credits are issued or sold to the market. The key to a successful streaming deal is ensuring that the streaming company has full or partial exclusivity and carbon rights on credits for at least five or ten years, and ideally over the full lifetime of a project.

Such a deal was struck by Key Carbon earlier this year, which is supporting the restoration of 7,000 ha of mangrove habitats implemented on the ground by the Worldview International Foundation (WIF). Key Carbon will invest up to $13mn by the end of 2023 in WIF’s blue carbon project portfolio, in exchange for getting access to 50% of all credits issued over the lifetime of the projects[3].

A similar method to streaming is that of royalties, which focuses on providing up-front cash in exchange for a percentage of revenue received from the future production and sales of a commodity. Contrary to streaming, this method does not involve receiving any physical commodity, or in this case carbon credits. An example of such a transaction is a recent deal between Carbon Streaming Corporation and Future Carbon whereby Carbon Streaming will receive a royalty of 5% from carbon credit revenues over the lifetimes of four REDD+ projects in Brazil, in exchange for an upfront payment of $3mn.[4]

While both models can be highly successful in the carbon market, streaming agreements tend to capture larger deal sizes and allow for more flexibility in deal-making compared to royalty agreements.

Why carbon streaming?

Streaming is an effective way for a project developer to raise non-dilutive project financing and get capitalised, without the need to give up their company equity or raise debt. The streaming model can also align the incentives between the financier and project developer, as both parties benefit from a revenue or carbon rights share split, in particular when it comes down to achieving a maximal price upon carbon credit sales. Finally, streaming or royalty companies tend to move faster than corporate buyers and have a higher risk appetite. That makes them ideal candidates if a project developer is looking to expand their carbon project portfolio and is looking for a long-term, but flexible form of financing.

Abatable believes the carbon streaming model has the potential to provide better-aligned and flexible capital to project developers relative to other forms of financing. In February this year, Abatable announced a strategic partnership with Key Carbon to originate and distribute high-quality carbon offsetting projects (see the announcement here).

If you are developing high-quality carbon projects in nature-based solutions, sustainable agriculture, waste management or methane reduction space, please get in touch with us.

References:

[1] Source - Ecosystem Marketplace

[2] Source - McKinsey

[3] Source - Key Carbon (formerly Carbon Neutral Royalty) Press Release

[4] Source - Carbon Streaming Press Release