Six months after COP26 in Glasgow, delegates representing more than 100 Parties to the Paris Agreement met in Bonn, to prepare for the upcoming UN Climate Conference (COP 27) in Sharm el-Sheikh.

An important focus of the discussion was Article 6, the Paris Agreement’s rulebook governing carbon markets. At Abatable, we’ve been following the discussions closely, given the increasing convergence between Article 6 and the voluntary carbon market (VCM).

This blog provides an update on Article 6.4, and and discusses its key implications for businesses aiming to procure carbon credits as part of their decarbonisation journeys.

What are the main aspects of Article 6 of the Paris Agreement?

We have covered the topic on our blog before and you can read the in-depth Article 6 explainer here. In short, the premise is that trading carbon assets across borders could reduce the cost of fighting climate change and therefore raise international climate ambition, as long as there is no double counting. This is based on the assumption that by making it cheaper to decarbonise by financing carbon projects in least-cost locations, countries will raise their Nationally Determined Contribution (NDC) ambition.

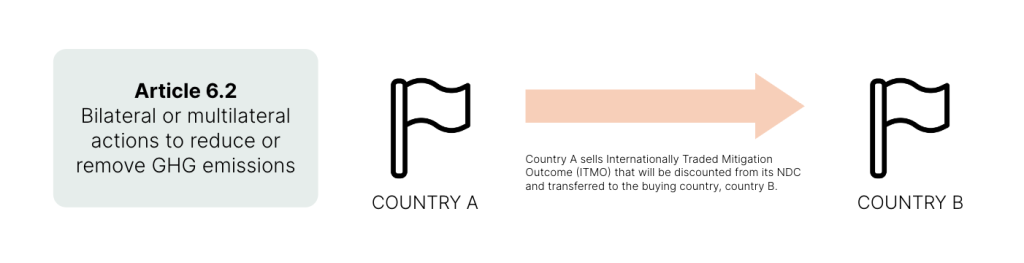

NDCs are countries’ plans to cut emissions and adapt to climate impacts, and are reviewed every five years. In order for Article 6 to be truly additional, climate negotiators agreed on the concept of corresponding adjustments. This means that if a credit is internationally transferred to another country or any other entity, it must be discounted from the host country’s NDC.

Based on that belief, Article 6 sets two international carbon mechanisms regulated by the UN:

- Article 6.2 establishes a market in which ‘Parties’ – i.e. countries or groups of countries like the EU – of the Paris Agreement can trade emissions reductions to achieve their NDCs. This is a country-to-country carbon transfer and trading mechanism. The carbon assets transferred are called Internationally Transferred Mitigation Outcomes (ITMO).

- Article 6.4 creates a market where public and private actors participate in countries’ reduction efforts by financing projects. 6.4 is considered to be the successor of the Clean Development Mechanism (CDM), the first international carbon market, developed under the Kyoto Protocol from 1997. This is where we expect a lot of convergence with the voluntary carbon market.

Most of the rule making around the 6.4 mechanism will be down to the Supervisory Board, whose role we discuss later in this article. The Supervisory Board is responsible for establishing the rules of the road under 6.4 and reviewing existing registry infrastructure and technical matters to allow 6.4 rules to become in operation.

Overview of Article 6.4 and associated claims when using carbon credits

How does Article 6.4 impact what companies can claim when using carbon credits?

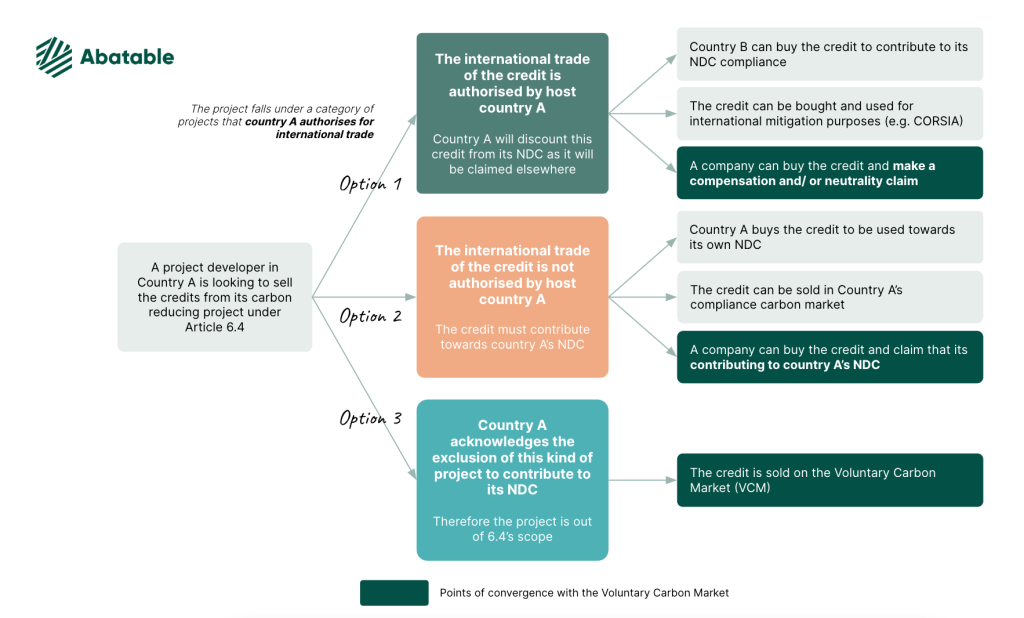

Once Article 6.4 is operational, we expect that private companies will have three types of carbon credits they will be able to purchase with different corresponding claims associated with them:

- UN-accredited carbon credits which have undergone a corresponding adjustment. In this case, the carbon credit is not counted towards the host countries’ NDC. The company purchasing the credit can effectively claim the credit as their own and make a compensation or carbon neutrality claim, following the guidance of the VCMI.

- UN-accredited carbon credits which have not undergone a corresponding adjustment, but still fall under the umbrella of 6.4, and will be counted towards the host country’s NDC. Private companies can purchase these credits to make a climate contribution to the host country. To avoid double-claiming, this type of credit should not be used to offset a company’s emissions.

- Carbon credits which have not been authorised to contribute to NDCs and therefore can only be sold on the VCM. These projects would typically fall out of a country’s NDC target provided the host country has explicitly carved out the project from its country’s ambitions. Uncertainty remains in today’s voluntary market particularly as national carbon policies and ambition have been revised and could see changes in policy’s direction impacting issuance of voluntary carbon markets to-date. A recent example of this policy change affecting the VCM is that of Indonesia which has set a moratorium on future issuances of credits under the VCM while it is defining its national carbon registry infrastructure and policies.

There are two important sources of uncertainty: (1) what the integrity initiatives such as the VCMI will recommend in terms of type of credits companies should use and, (2) what the scale of supply and demand of credits under Article 6.4 will look like and therefore what the price of carbon credits will look like. Whilst market participants expect issuance of credits to be delayed by the country’s authorisation process, corresponding adjustments may reduce risks around ambiguous titles and increase integrity of claims, with some participants expecting a higher price commanded for CA eligible credits in the future.

What type of carbon credits are included under Article 6.4?

A key question for companies aiming to leverage carbon credits is what type of credit (i.e. avoidance, reduction or removal) they will be able to purchase under Article 6.4. This is important as, for example, guidance from the Science Based Target Initiative specifies that only carbon removal credits should be used towards net zero targets.

As of today, there is no official definition of removals, reductions, or avoidance as part of Article 6. Given the lack of alignment on what “avoidance” means, there has been no outright inclusion or exclusion of REDD and some market participants have suggested REDD credits should be considered outside of 6.4, also in light of the fact that CDM did not cater for the inclusion of REDD. It will be up to the Supervisory Body to decide what type of solution is, and isn’t, eligible.

Another key consideration is whether Article 6.4 will allow independent registries such as Verra or Gold Standard to participate in the mechanism and supply credits. This is something that delegations from the US, Canada and Singapore pushed for at Bonn. This could displace a lot of credits from the voluntary market and restrict supply, forcing companies to choose UN-accredited credits. Yet, many negotiators have pushed back on the idea of independent registries being part of the 6.4 mechanism, and it may well be that the Supervisory Board will only authorise projects which meet its own methodologies and go through its approval requirements.

What is the timeline for the implementation of Article 6.4?

One of the main developments of the Bonn Conference is the appointment of all members of the awaited Supervisory Board just a few days following the end of the Conference. This is an important step as the Board is responsible for determining key aspects of the mechanism, including: what happens with the Kyoto protocol’s legacy Clean Development Mechanism credits, approved methodologies of projects under the new mechanism, key definitions such as ‘removal, reduction and avoidance’ as well as guidelines to national governments and private actors as to how to account for corresponding adjustments.

The newly appointed Board has a big mandate, and agreeing on the above points will inform the timeline of implementation of Article 6.4. According to several experts, the first credits under Article 6.4 are expected to be issued two to two and a half years from now.

Conclusion

In summary, the mechanism under Article 6.4 has large implications for the voluntary carbon market as a whole and dictates the role of private actors within a country’s NDA agenda. The availability of credits to make compensation claims could drastically reduce if countries decided to not authorise credits for international trade, incentivising companies to make climate contributions claims instead.

The implementation of Article 6 has implications when it comes to the accounting of claims – requiring the establishment of new global and national carbon registry systems. The supply and demand, and as a result price of credits, will depend on key decisions of the Supervisory Board, which has no easy task than to give a more certain direction of travel for what is to this day a voluntary carbon market with an increasingly uncertain rulebook.