Throughout our carbon procurement series, we’ve outlined different considerations when building your science-aligned carbon procurement strategy. Increasingly, corporates are recognizing the urgency of climate action as demonstrated by a rapid acceleration of corporate’s net zero plans.

But, in the absence of specific guidance, corporate approaches to climate action through carbon credits and the claims associated have varied widely to date. Once a company has set their annual budget, there are different approaches to procurement they can take, which we discuss in this blog.

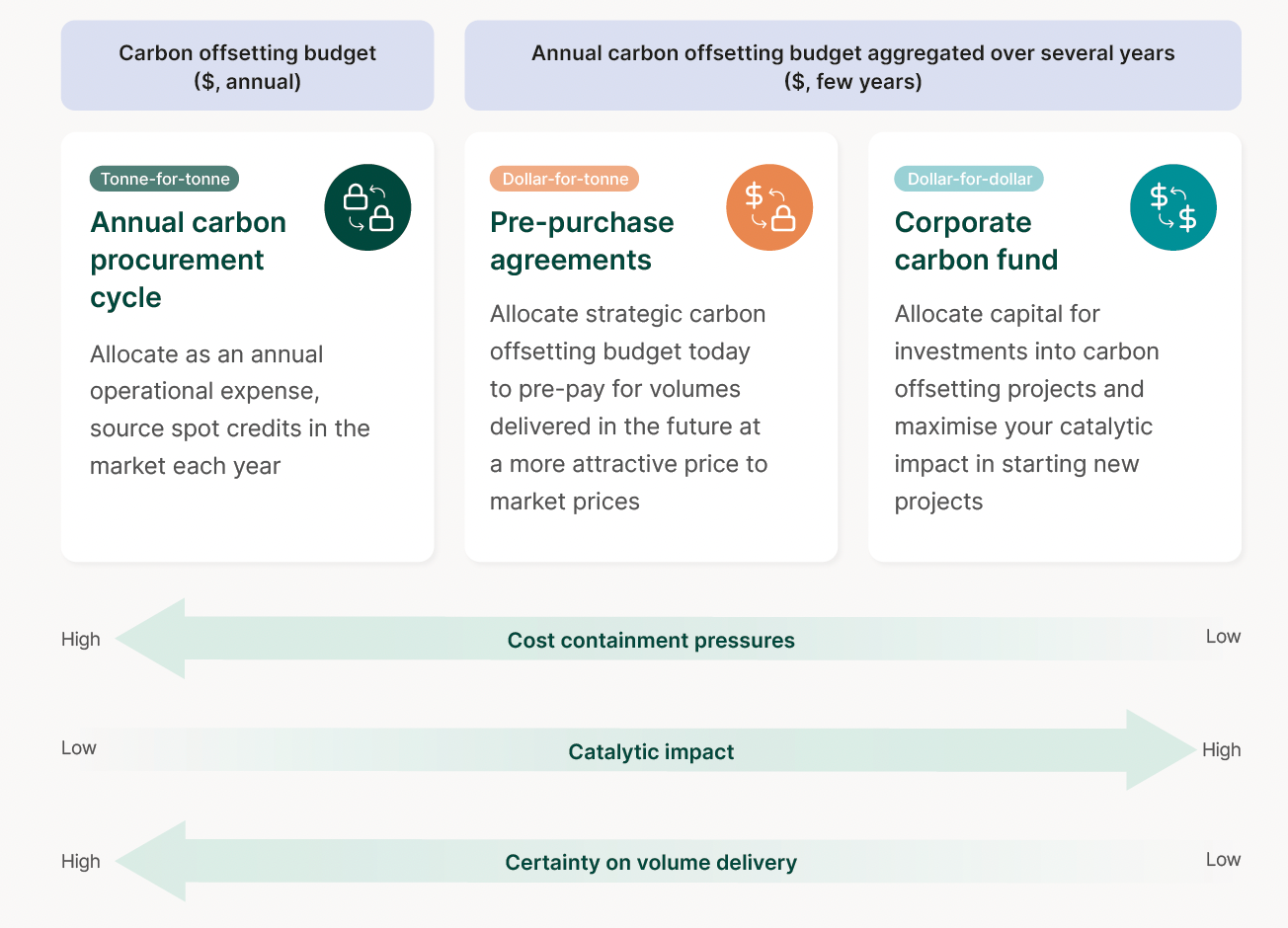

Different procurement approaches

Historically, companies have purchased carbon credits to make carbon neutrality claims at a company level or product level (e.g. carbon neutral flights). This approach has been under a lot of scrutiny recently with the European Union and other jurisdictions seeking to regulate the claims companies make to protect consumers from greenwashing. Corporates are increasingly turning their attention to making “climate contributions” as part of their climate action plans and requirements. Corporate climate contributions include all those activities which refer to actions or investments that fall outside of a company’s value chain and are intended to offset, reduce or remove residual, hard-to-abate carbon emissions in corporate supply chains.

Tonne-for-tonne

A tonne-for-tonne approach where companies purchase carbon credits and retire them like-for-like. If a company has 100 tonnes they need to offset, they will purchase 100 tonnes of carbon credits. This approach has been used by some European utilities who offer “green tariffs” to commercial and residential customers. These credits are bought on behalf of customers to match up all emissions linked to their non-green energy consumption in the energy mix. A tonne-for-tonne approach goes hand in hand with “carbon neutral” or “climate neutral” emission claims and is assessed from a carbon accounting standpoint. The main challenge with this approach is that it incentivises companies to optimise for a low carbon price.

Although we are seeing a move away from carbon neutrality, tonne-for-tonne continues to be the recommended model by VCMI but setting strong minimum criterias for claims, such as having science based targets and being on track to meet them.

Dollar-for-tonne

A dollar-for-tonne approach where a budget to support carbon offsetting projects is allocated but the company is not focused on optimising for a specific volume of carbon credits and it may be willing to accept some degree of carbon delivery risk over time. This can be allocated today based on the projected annual budget over several years. This approach is used by buyers who may have a lower price sensitivity and may be able to spend more on a per tonne of CO2 equivalent avoided or removed basis. It is also often used as a way to support the development of innovative carbon removal companies or technologies. This approach is used by corporate offset buyers that don’t have stringent regulatory requirements or public pressure to offset their carbon footprint. Instead, they are usually interested in offsetting partial emissions and publicising these climate contributions as part of their net zero plan.

This approach is best illustrated by Stripe Climate’s carbon removal commitments which saw the financial technology company commit $15 million as a way to pre-purchase some carbon offsets from four innovative carbon removal technology projects.

Dollar-for-dollar

A dollar-for-dollar approach where a company is positioned as an investor in a carbon project and benefits from a return of investment on the initial upfront investment and/or preferential access for receipt of carbon credits. Corporates can have preferred access as an offtaker of the carbon credits generated by the portfolio of projects. However, given they are an early-stage provider of capital to get the project off the ground, they may be subject to investment-related risks. Those risks can include but are not limited to, exposure to large carbon under-delivery risk if the project is not able to deliver the volume of carbon credits as planned.

This approach is best illustrated by Shell, who have been actively investing large sums in a series of carbon projects in partnership with a network of high-quality carbon project developers. Shell announced a $1.6 billion joint venture with EKI Energy Services to invest in the creation of portfolios of nature-based carbon credits, as well as a large investment in C-Quest for the creation of a portfolio of carbon credits from clean cooking stove projects. Some of these credits may be used by Shell for its corporate offsetting needs in the future, but could also be re-sold to Shell’s corporate partners and clients for a profit.

Which approach to choose?

As illustrated below, the right approach for your company will depend on three main factors: 1) what are your cost containment pressures? 2) what kind of impact are you trying to achieve and 3) how important is volume delivery to your claim?

For example, a company with a specific target of making climate contributions that meet 100% of their annual emissions this year will probably be looking at a tonne-for-tonne approach. Yet, for the years to come, it could consider a mix of pre-purchase agreements and tonne-for-tonne to ensure it secures sufficient credits and maximises catalytic impact. On the other hand, a company with a longer-term nature-positive target could consider a corporate carbon fund to make a much more strategic approach and have a higher catalytic impact.

Conclusion

We hope this blog post helps you determine the approach to procurement that’s best for your company. Next in our carbon procurement series, we will discuss how to select project types that align with your impact agenda, how to enter the marketplace and purchase credits, and how to carry out your due diligence through monitoring and reporting. Can’t wait? Grab our guide and watch our corresponding webinar on Youtube.