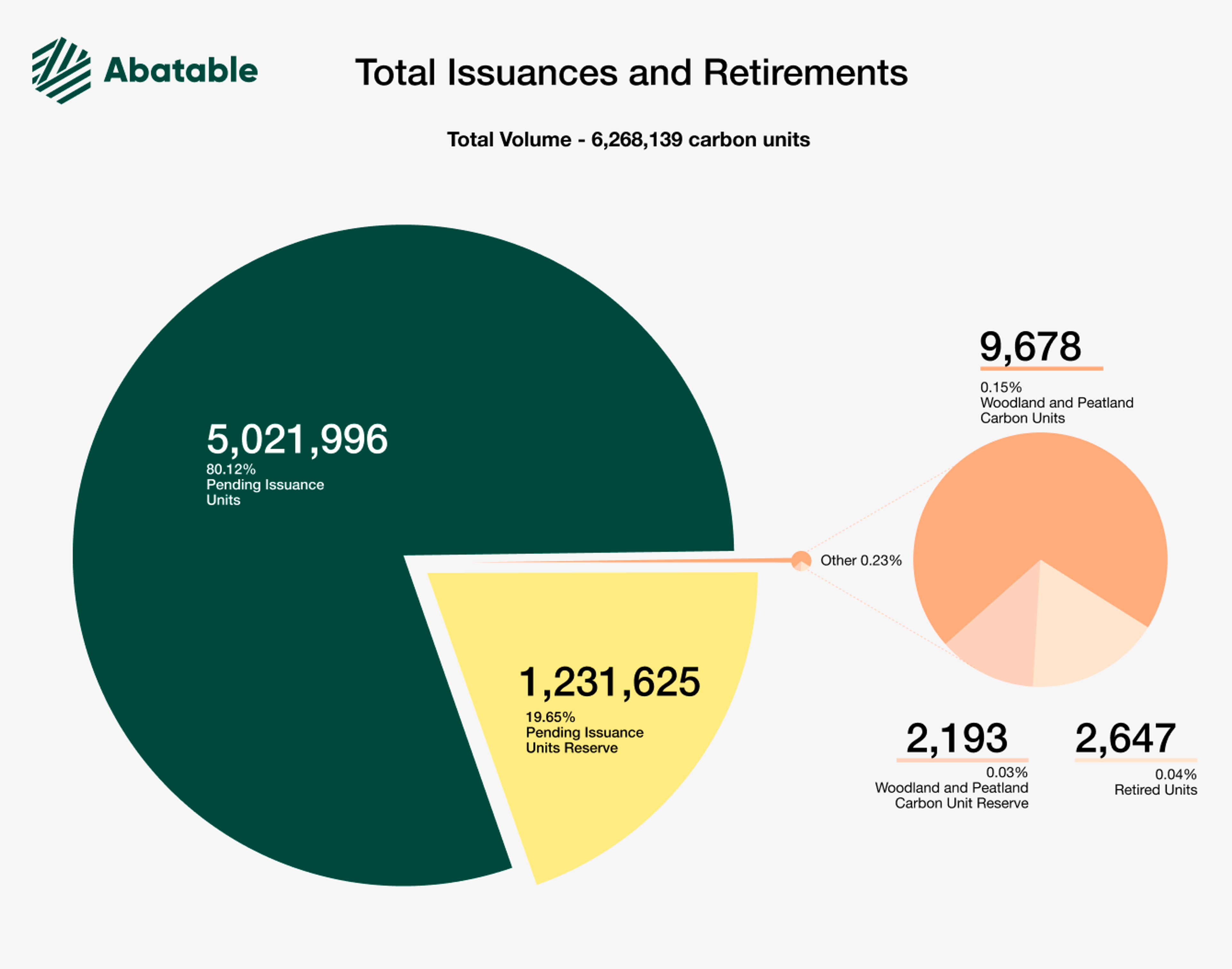

The UK Voluntary Carbon Market: Graph showing the total volume of credits by credit type: Pending Issuance Unit (ex-ante credits), Woodland / Peatland Carbon Units (ex-post credits) and Retired units (credits that have been purchased and retired).

The State of UK’s Voluntary Carbon market report is a snapshot of the UK voluntary market today. It investigates the potential significance of this market, how it is structured and explores the current state of supply. We believe understanding the maturity of this market is important in informing buyers about the potential risks and opportunities that exist whilst procuring UK carbon credits.

About this report

We have analysed and aggregated data from the UK Woodland Carbon Code (WCC) and the UK Peatland Code (PC) which is made publicly available through the IHS Markit Environmental Registry1. Data used is as of February 2022. The report also includes proprietary data from Abatable based on conversations with a network of project developers and key stakeholders.

Why focus on the UK voluntary carbon market?

The UK government has the world's most ambitious legally binding target of reducing its 1990 emissions level by 78% by 20352, this is equivalent to a 34% reduction relative to the UK’s 20193 emissions level. As of April 2022 the UK will also be the first G20 nation to enshrine climate-related financial reporting into law.

Such bold legislation is increasing the pressure on UK companies to create net-zero strategies. 60% of the FTSE 100 are already committed to reaching net-zero by 2050 under the UNs Race to Zero pledge4. Many companies are looking to offset their hard-to-abate UK emissions with UK projects that are tangible to stakeholders.

The development of the UK Voluntary Market is integral to both the UK’s legal requirement to reach its climate targets as well as UK companies to meet their own targets.

Download the report

Visit the report page to download the full document.

Key observations on the UK Voluntary Market

Current supply of verified credits is minimal

Just over 6 million carbon credits have been issued, verified or retired under the WCC and PC. This is a de minimis supply compared to anticipated demand. For example, 90 million tonnes of CO2e of emissions were generated in 2019 alone by the top 10 largest UK companies by revenue in the Fortune 500. Retired credits under the Woodland Carbon Code represent only 0.04% of the total volume of credits (or an equivalent of 2,647 tonnes of CO2e).

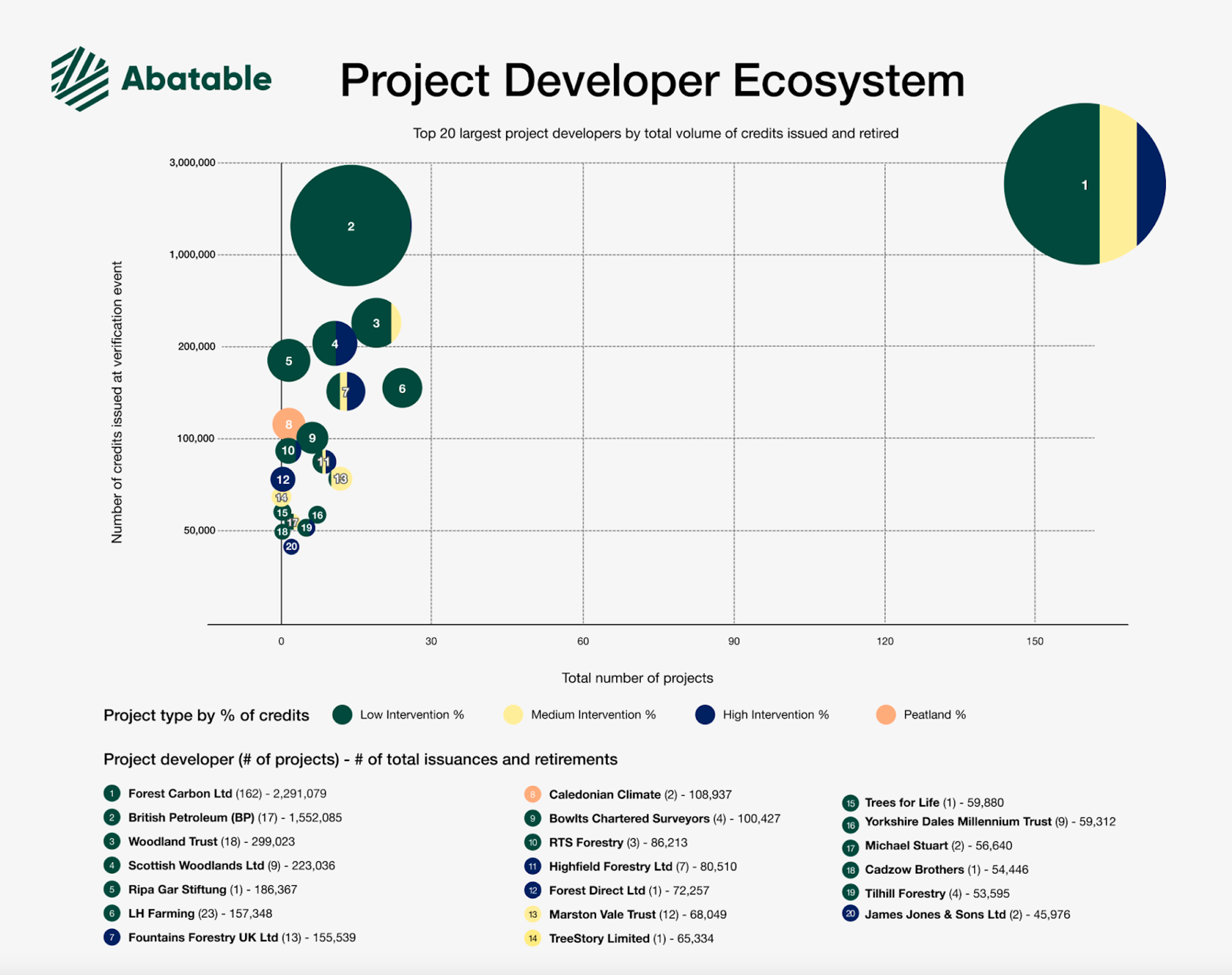

Few project developers dominate the market

Out of a total number of 168 project developers, only 55 have ever issued or retired credits. The existing market and future supply is dominated by early players in the WCC, with just the top two developers representing 61% of all credits issued and retired to date. The top 20 developers account for 92%. There is however an influx of new market entrants including large private landowners and investment funds with significant pipelines of projects who are looking to scale.

Growth potential for verified credits is limited by long verification cycles

Verification cycles on a 5 or up to 10-year basis combined with slower rates of growth from UK forests means buyers will have to wait a long time to see their PIUs turned into verified credits which can be used for carbon claims. Supply from pipeline projects is expected to boost total volumes of credits from 6.26 to 19 million tonnes of CO2e over the next 100 years. This is still limited compared to anticipated demand from both corporates and the UK government.

About the Author

Tim Maxwell is a Carbon Specialist at Abatable. He has an MA in Geography from the University of Edinburgh and has completed permaculture courses in carbon, woodland management and soil ecology.

About Abatable

Abatable is a carbon procurement and market insights platform for carbon project developers, corporates and investors. Our platform connects project developers to corporates and capital providers interested in long-term carbon offtake agreements. As operators in the voluntary carbon market, we have developed an understanding of the carbon project developer ecosystem, with key observations summarised in this report.

If you have any questions about this report, have any feedback for us, or would like to enquire about a partnership, please get in touch.

1. IHS Markit, 2022. Markit Environmental Registry - Public Reports. [online] Mer.markit.com. Source.

2. GOV.UK, 2022. UK enshrines new target in law to slash emissions by 78% by 2035. [online] GOV.UK. Source.

3. GOV.UK 2022. 2019 UK Greenhouse Gas Emissions, Final Figures. [online] Source.

4. EDIE, 2022. 60% of Britain's largest businesses now signed up to Race to Zero. [online] edie.net. Source.