It is critical that more ambitious measures are taken to improve the sustainability of agricultural value chains if global climate and nature targets are to be achieved. There are clear steps to take on both the supply and demand side of the market to boost investment in value chain interventions, as recent reports from Abatable, the International Platform for Insetting (IPI) and the World Business Council for Sustainable Development (WBCSD) demonstrate.

It is no longer an option for companies to ignore the impacts of their supply chains.

Scope 3 emissions – those that appear in the company value chain – typically account for the majority of a given business’ carbon footprint. This is particularly the case within agricultural supply chains, with agrifood systems accounting for around a third of anthropogenic global greenhouse gas emissions – mostly from farm-based activities and land use change.

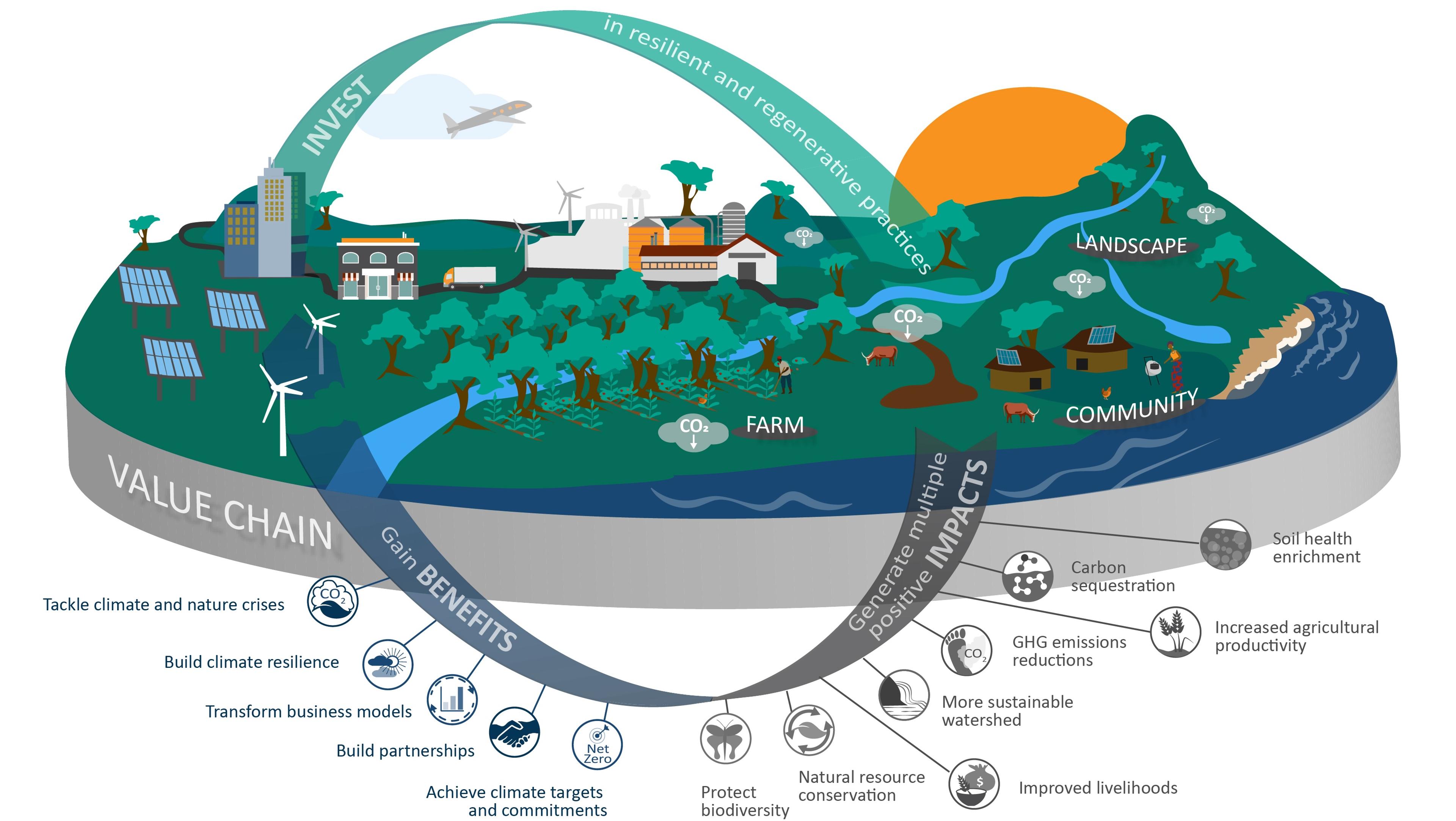

Food systems need to be radically reformed if climate targets are to be met and the world is to be fed in a more secure, sustainable and resilient fashion. This was formally recognised in Dubai at COP28, with governments making a declaration on sustainable agriculture and pledging to work together to accelerate food system transformation. Interventions in the agriculture value chain – also known as insetting (see Figure 1) – will be a key mechanism to enable this to happen.

However, in-value chain interventions are still relatively nascent, with market actors stalling action while guidance on best practices and approaches is still in development. Two recent reports from Abatable, IPI and WBCSD focus on how to address these challenges from two different perspectives.

Abatable and IPI’s report, Addressing Scope 3 – how insetting can be scaled to tackle supply chain emissions, is based on 20 qualitative interviews with insetting project developers and focuses on the supply side of the insetting equation.

WBCSD’s report, Scope 3 action agenda for the agrifood sector, takes a closer look at the demand side and is based on WBCSD’s work with its members and partners, summarising the findings from interviews and workshops with corporates in the agricultural sector in 2023.

The findings of both reports will be discussed in an upcoming webinar, How to scale supply chain interventions in agricultural value chains, taking place on 24 January 2024, 16.30 CET.

Cross-market action areas

While each report comes with its own specific recommendations, there are a number of common insights integral to the success of in-value chain solutions.

Effective guidance and standards

Most importantly, there is a strong need for fundamental, unified and trusted guidance on defining and measuring agricultural in-value chain interventions. This is evidenced by the fact that the understanding of insetting best practices varies considerably between stakeholders across the sector.

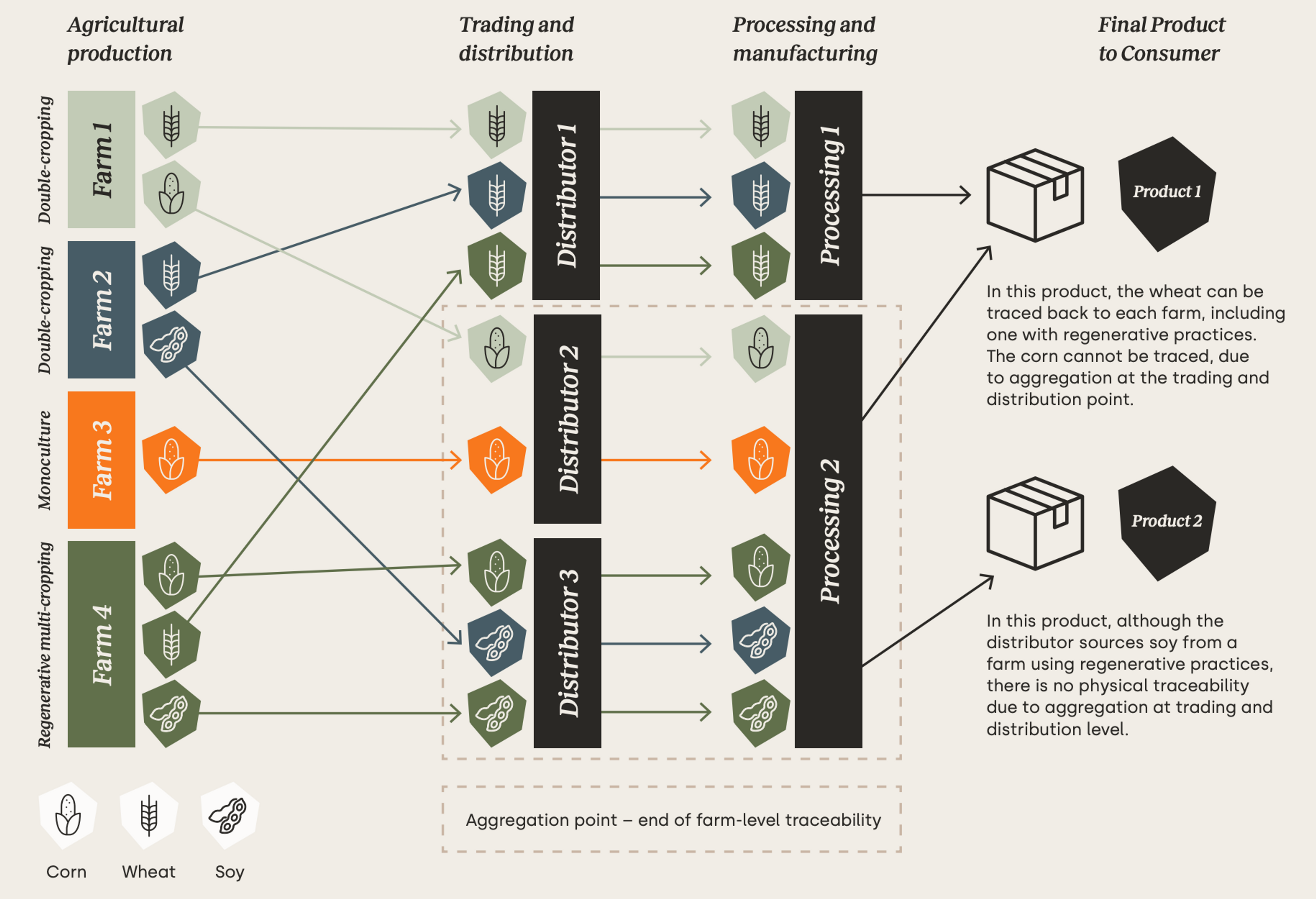

It is clear from WBCSD’s research that corporates need robust and pragmatic guidance and standards to set targets and account for and disclose their agricultural value chain emissions. Businesses are navigating a complex landscape of emerging frameworks and tools to come up with a clear direction amid a growing requirement for Scope 3 disclosure requirements. Abatable and IPI’s report also highlighted the importance of pragmatism due to the diverse traceability maturity of different commodities.

In this vein, participants on both sides of the picture are eagerly awaiting the GHG Protocol’s Land Sector and Removals Guidance, expected to be finalised later this year. It is critical that this document provides clear and usable guidance for market participants.

Clear and consistent guidance is sorely needed to enable insetting practices to scale effectively. This includes the clear adoption of pathways for businesses to develop and scale credible in-value chain activities.

Supply chain boundaries

Closely related to unified standards is the need to achieve consensus on where the boundaries for value chain interventions lie. Are they on-farm, in the supply shed or do they extend to the wider landscape?

Stakeholders are currently taking a variety of approaches, and so there is a blurred boundary between where a Scope 3 reduction claim stops and a Beyond Value Chain Mitigation (BVCM) claim starts. The strategic role of BVCM for agrifood companies and how these relate to emissions-reduction goals is also not clear.

The intertwined and complex nature of agrifood supply chains (see Figure 2) means that corporate action towards climate and nature goals requires action at a landscape level (i.e. considering both within and beyond-value chain). These landscape-level activities can support greenhouse gas emissions reductions and removals, as well as other positive outcomes for nature and livelihoods.

Robust and pragmatic consensus on these points is needed to avoid emissions double counting and to incentivise the adoption of insetting activities in production landscapes. This will also enable in-value chain and beyond-value chain approaches to be deployed in a strategic and complimentary fashion.

Accounting and MRV

Where boundaries sit will in turn play a large role in emissions reductions accounting.

WBCSD members highlighted that there is a lack of practical accounting approaches for companies to quantify emissions reductions and removals from specific interventions, and to monitor, report and verify impacts. This needs to change if businesses are to have the tools to identify the most effective action, whether these are based on primary or secondary data. Sector-aligned data requirements and interoperable MRV systems are needed to accelerate the adoption of the required standards and frameworks.

These messages are strongly amplified in Abatable and IPI’s report, which finds that standard setters need to increase alignment on accounting while retaining a degree of flexibility as methodologies are being developed. A modular, adaptable approach will be needed to balance flexibility with stringency across the various insetting environments.

Similarly, Abatable and IPI also found that there is a clear need for alignment on the associated insetting emissions reduction claims companies can make. The report recommends project developers work to leverage existing infrastructure like certifications and supply chain custody systems to address traceability gaps. This will help promote integrity and transparent data sharing without reinventing the wheel.

Farmer support

Finally, both reports also highlight the need for farmers, who are already squeezed, to be adequately compensated for their role in implementing emissions reduction and removal interventions.

Corporates and their partners are looking to finance farm and landscape-level action, but achieving scale is complicated by the current challenges producers see when trying to share costs across buyers. In turn, buyers then struggle when it comes to claiming or co-claiming the emissions reductions or removals realised.

Consensus is therefore needed on mechanisms to prioritise the equity of farmers in Scope 3 accounting and interventions to bring stability in investment for producers to take action, including providing the necessary pre-finance to support farmers with the transition to more sustainable practices. Co-investment opportunities need to be facilitated to allow economies of scale, with clear principles established to adequately reward farmers for the ecosystem services they are investing in.

It is important that companies recognise that high-quality insetting projects come with a cost. But it is also critical that they realise the additional long-term direct business benefits that come from investing in their supply chains, which include greater resiliency and preparedness for future mandated carbon pricing schemes.

Moving forward

It is clear from Abatable, IPI and WBCSD’s work that the unclear in-value chain landscape, twinned with a fear of stakeholder scrutiny, is resulting in many companies lacking momentum in taking insetting action.

What is also clear across all sides of the insetting picture is that collaboration will be key to developing consistent standards, guidance and innovative solutions. Achieving clarity on geographical boundaries and emissions accounting will enable credible claims and will power scalable, high-integrity insetting.

With the right frameworks in place, in-value chain action can truly scale as an effective part of the climate solution toolkit.

To learn more, tune into Abatable, IPI and WBCSD’s joint webinar, How to scale supply chain interventions in agricultural value chains, on 24 January, 16.30 CET, where you can hear directly from and question practitioners in the insetting space. Register your interest here.